Written by Summit Life based in Ballsbridge, Dublin.

Peter and Sarah are a married couple. Peter is 32 and Sarah is 30 years of age.

They have one child who is two years of age. They are both in full-time employment. Peter is a solicitor who has been working for the past two years with one other solicitor in partnership and the business is growing and doing well. Sarah is a primary school teacher and has returned to work on a full time basis. They are expecting their second child in six month time.

Summit L&P began the planning process by, firstly, carrying out a detailed fact-finding exercise with Peter and Sarah. This is always the starting point of every initial meeting with new clients. This allows us to build a proper picture of a clients current financial position and also to drill down and find out exactly what are the clients needs and objectives.

Outlined below are some of the specific findings from the detailed fact finding exercise we carried out:

- Peter was the only life that was covered on the life cover policy which they had in place to cover the mortgage (loan) on the house

- The only other life cover benefit they had between them was Sarah’s death in service benefit from Sarah’s job (2 times salary)

- They had no serious illness cover on either life

- Peter had no income protection cover in place in the event that he was unable to work due to ill health or accident. This was of concern due to the fact that Peter is self-employed and not entitled to receive any state financial help if he is out of work. Sarah is covered by her employer in the event that she is out of work for a prolonged period of time

- They have an emergency fund built up in their current account of six months net salary

- Peter has a small pension from his time working in a law firm with a current value of approx. €35,000 and does not know what it is invested in. Sarah has a defined benefit pension from her current employment which has excellent benefits attaching

- They have a monthly savings plan with their bank into which they are currently paying €250 per month between them. The current value is approx. €15,000 and it is invested in cash

- Peter and his business partner currently do not have a tailored-made shareholders agreement in place and they also do not have any partnership cover (life cover). Partnership cover is a life cover benefit that is put in place to protect the partners of a business in the event that one or more partners of the business were to pass away unexpectedly. The benefit from the life cover policy can be used by the surviving partners of the business to buyout the spouse/estate of the deceased partner

After analysing the above information and speaking to Peter and Sarah with regards to what their needs and objectives were, we came back with the following recommendations:

- The first priority was to put in place adequate life cover for both of them in the event that either of them were to pass away. We suggested that they should put in place a mortgage protection (life cover) policy on BOTH their lives for the mortgage on the house. We also calculated that they required a further €750,000 life cover on Peter’s life as he was the higher earner and €450,000 on Sarah’s as she had some life cover from her employment (death in service of 2 times salary). Also they will soon have a new born baby so they will have a financial need for at least the next 20 years while they raise their family. As Peter is self-employed we suggested putting in place a Pension Term Assurance (life cover) policy for €750,000 as he would be able to get tax relief on the premiums at his current rate of tax (40%). This will help reduce the cost of the policy. Sarah would not be able to put in place this type of policy as she is currently in pensionable salaried employment. Therefore, we recommended she should put in place a personal protection policy for the €450,000 with a 20 year term

- As Peter is a sole-trader and not entitled to any financial help from the state in the event that he is unable to work due to illness or accident, we recommended that he put in place an income protection policy for the maximum allowable benefit (75% of earnings). This type of benefit is paid out to the claimant on a monthly basis and is subject to tax just like a normal income. Like a person’s normal income, it will help pay for the required day to day living expenses we all have to deal with (mortgage, food, utilities, clothes etc). As Peter is a higher rate tax payer (currently 40%), he would be able to receive tax relief at this 40% rate which makes the cost much more reasonable. Sarah currently has this type of benefit from her employment so does not require to put anything in place

- The reality of one of them getting diagnosed with a serious illness is unfortunately very real. Serious illness cover pays out a once off lump sum which can be used to pay down some of a mortgage, medical expenses etc. We recommended that they put in place a dual life serious illness policy of twice their net salary which is €150,000

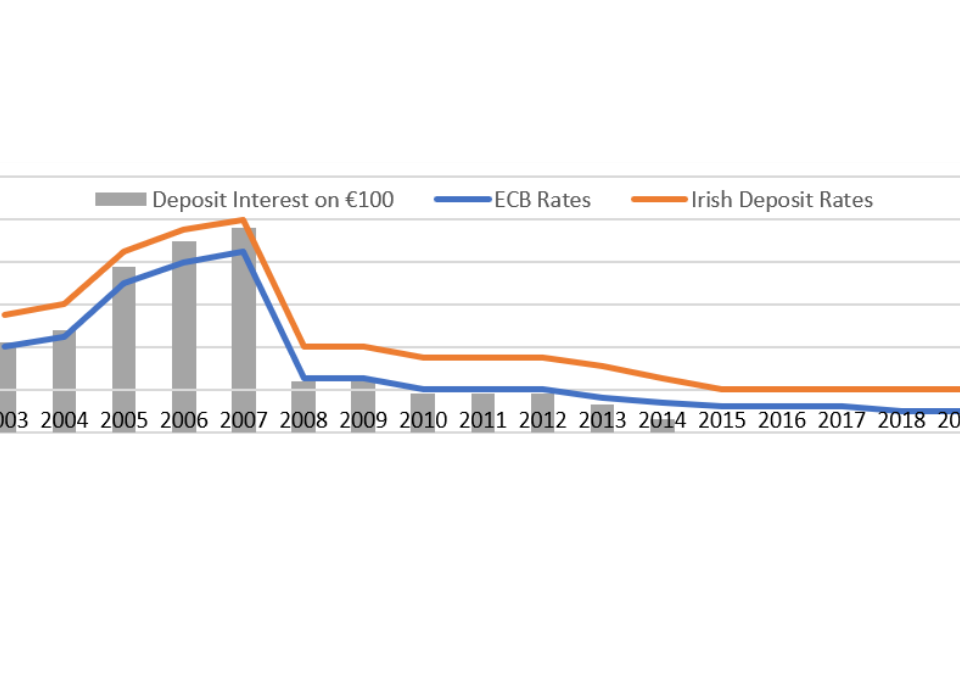

- As they currently have an emergency fund built up, we would recommend that they try to obtain the best possible deposit rate from one of the institutions but to make sure that they can get access to it within a short time period without big penalties

- Peter currently is not funding for a pension and has a small pension fund from a previous employment. After speaking with Peter about the type of pension fund he would hope to build up to meet his retirement goals, we recommended that he switch the value of his fund out of his old employer scheme and into his own personal retirement bond (PRB) policy which he would control. Also, he should set up a personal pension plan and start contributing an affordable amount per month. A risk profiling questionnaire was completed to ensure we helped him invest in suitable funds matching his appetite for risk on both policies

- They are currently putting €250 per month into a savings plan which is invested in cash. Cash over the medium to long-term will not beat inflation. The purpose of this money is for the children’s second level education. Therefore, it is not required for at least another 10 years. We recommended that the existing fund (€15,000) and the €250 per month should be invested in a life company savings policy which provides access to many different types of funds to invest in (equities, bonds, property, cash etc). This enabled us to put in place a suitable fund strategy to try and obtain good returns over the investment period

- Finally, Peter and his business partner do not have any partnership cover in place. This is a very important type of cover which will protect both Peter and his business partner and their families in the event that either of them passes away unexpectedly. After consultation with their accountant to get a fair open market value of the business (€500,000), we put in place two life cover policies for €250,000 on each of their lives. Also we recommended that they sit down together and put in place a proper partnership agreement.

Summary

As mentioned already, it is vitally important and part of Summit L&P’s client agreement to review all these types of policies and their individual financial position at least annually. Things change very quickly in life so it is therefore very important to review all of the above regularly.