Written by Penco based in Dublin 7.

Part of being alive means that one day we will reach old age. Given that life expectancy in Ireland is 81 years old, we spend about two thirds of our lives preparing ourselves to get there. This means that there is sufficient time to maximise wealth and secure retirement so we can benefit from all those years of hard work.

Penco helps you decide which is the best way to invest in your future self. If you are self-employed or don’t have a retirement plan you contribute to, we can guide you through setting up the optimal structure to ensure you don’t have to compromise your lifestyle when you no longer have to work.

Both the Government and private institutions offer funds and pensions — as well as other types of investment — which are viewed as long-term contracts. Penco is here to advise you and set up the most convenient form of investment according to your lifestyle and aspirations. Take a look at some solutions:

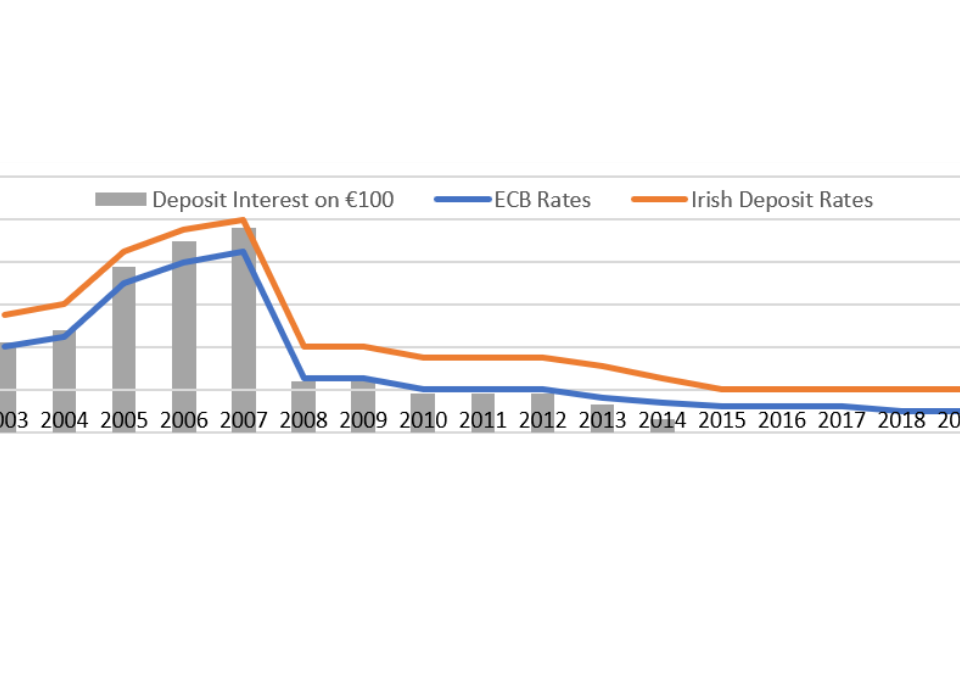

Savings. The definition of savings is ‘money you set aside for a specific purpose’ and therefore doesn’t mean you have to refrain from buying the product you’ve had your eye on. When we talk about savings, we are actually talking about planning and responsibility.

Savings are the most flexible way to plan your retirement or save enough for a personal or professional project, and not to mention, for any unforeseen financial circumstances. We help you find the plan which most suits how you want to save and access your money. We will also guide you on how to utilise your relationship with institutions such as banks and credit unions.

Protection. Penco provides assistance in choosing between different categories of insurance. It’s an intelligent way to establish how much both your tangible and intangible assets are worth so you pay a fair amount for the protection you want.

We offer contracts for different purposes:

-

Mortgage Insurance, designed to protect both parties in this intricate financial transaction.

-

Income Insurance, which helps you meet your financial obligations in case of income shortfall.

-

Specified Illness Cover, to grant you financial relief when you come down with an illness that requires ongoing treatment.

-

Estate Planning, which is a secure way to pass your wealth to future generations.

-

Life Insurance, which ensures an adequate provision for your loved ones in the unfortunate event of your passing.

Pensions. There are many pensions designed specifically for self-employed people, and they all bring certain advantages depending on your lifestyle. Not only are there flexible solutions, but they can also can be maximised in order to increase the total sum at your retirement. Best of all, this doesn’t necessarily mean you are required to make big a sacrifice in your income now as we will direct you on how to claim tax relief on your contributions.